“Whatever is in the heart will come up to the tongue.”

– Proverb

“Whatever is in the heart will come up to the tongue.”

– Proverb

Our passion to outperform is intended to help deliver excess returns to your portfolio; our transparency helps keep you in the know; and our cost-efficient business model is designed to pass savings to your organization.

We only do what helps to outperform, and we only hire people who we believe can outperform. Our business centers upon creative research to push boundaries between the known and the unknown. At Qtron, we ride technology waves to shake the foundation of the investment management with passion, creativity, and humility.Read More

“Others have seen what is and asked why. I have seen what could be and asked why not.”

– Pablo Picasso

Our success is always and everywhere a matter of your trust. And we are transparent to earn it. We do not subscribe to the practice of corporate bureaucracy filled with misaligned incentives and accountability vacuums. At Qtron, you know who loses sleep over your portfolio.Read More

“Everything you add to the truth subtracts from the truth.”

– Aleksandr Solzhenitsyn

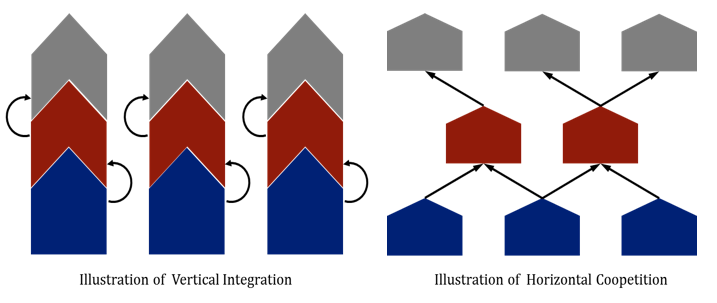

Advancements in technology have reduced transaction costs that glued together vertical integration and economies of scales in the past. Today, horizontal “coopetition” — cooperative competition — drives down costs and improves efficiency. At Qtron, we embrace modern technology and strive for a low corporate overhead and a lean technology infrastructure.Read More

“Everyone takes the limits of his own vision for the limits of the world.”

– Arthur Schopenhauer